Sam Bankman-Fried cut an unlikely figure as he took the stage on the final morning of this year’s big derivatives-industry conference in Boca Raton, Florida. Sporting a grey T-shirt, khaki shorts and sneakers, his mane of curly hair untamed, the 30-year-old chief executive of FTX looked more like a student who had just rolled out of bed to grab breakfast at his college cafeteria than the boss of an international cryptocurrency exchange valued at $32bn.

Adding to incongruity at the Futures Industry Association event was that Bankman-Fried was engaging in a one-on-one chat with Alex Rodriguez, the retired American baseball star, broadcaster and business executive known as A-Rod. Standing a good six inches taller than his interlocutor and still fit at 46, the one-time fiancé of Jennifer Lopez was every inch a red-carpet celebrity in his dark suit, white shirt and power tie.

But it was A-Rod who was out of his league.

Bankman-Fried had already stolen the show at the March gathering with a groundbreaking proposal to US regulators to automate risk management in financial markets — using practices developed for digital assets. FTX says it plans to start with a small market — leveraged futures contracts for cryptocurrencies. But it raises the possibility of a brave new world in which traditional brokers would be replaced by computers, and machines would make margin calls in 24-hour-a-day, seven-day-a-week trade.

As he compared notes with Rodriguez, Bankman-Fried stuck to a futuristic vision, holding forth at length on the “really beautiful experience” of using some of the new protocols being built on blockchains, the distributed ledger technology underpinning cryptocurrencies. By the time he finished, the former New York Yankees slugger was a gushing fan. “This guy is way too smart,” he said.

The warm reception given to the young man in short trousers by the folks in suits at the Florida pow-wow was something of a surprise. Bankman-Fried and his industry are controversial. An American citizen, he is a paper billionaire many times over based on his majority interest — his exact holding has not been disclosed — in an international crypto exchange that is incorporated in Antigua and Barbuda and operates with a licence issued by the Bahamas. His three-person board has one outside director, a lawyer in its corporate home country.

The crypto business faces headwinds on multiple fronts. Gary Gensler, US Securities and Exchange Commission chair, has said there is a “great deal of hype and spin” about how digital assets work and a lack of investor protections in the “Wild West” markets where they trade. Lesser authorities have wondered how coins named after little dogs or non-fungible tokens depicting bored apes could be worth so much. Hopes that bitcoin would function as a kind of digital gold have been undercut by its difficult-to-explain price movements in crises.

Yet Bankman-Fried created a buzz in Boca by focusing less on what is being traded on exchanges such as FTX and more on how it is being traded — the implication being that the gold might be in the new financial plumbing itself rather than what flows through it. In the process, he took a far different approach to dealing with the government than his more combative brethren in the libertarian-leaning crypto community. He invited oversight and sought a dialogue with the regulators — which he has received.

Rostin Behnam, chair of the US Commodity Futures Trading Commission, which regulates derivatives markets, addressed the FTX proposal in a speech at the same event. While pledging to be “careful, patient and deliberative with this request”, Behnam also expressed public admiration for the ideas behind Bankman-Fried’s argument.

“The request represents an innovative proposal that deserves careful consideration,” Behnam said, adding: “It has never been, nor should it ever be our job to choose winners or losers in the industry. Only the market and the customer can do that.”

Trading day and night

The CFTC itself set the stage for Bankman-Fried’s star turn only five days before the conference. On March 10, it issued a request for public comment on a proposal by the US derivatives arm of FTX to allow a small US futures exchange it bought last year to offer leveraged futures contracts.

The products it currently offers to retail investors are — to use the industry lingo — “fully collateralized,” meaning FTX takes no credit risk. With leveraged futures there is a big difference. These contracts enable investors to take large positions while putting up a fraction of the value of the trade, known as margin. The leverage means investors can get more bang for their buck if things go right. The margin functions ensure that a soured bet and default doesn’t cascade through the financial system.

The novel part of the FTX proposal is how it deals with margin. In today’s markets, brokers known as futures commission merchants, or FCMs, collect margin and make sure customers have enough of it to support their positions. If they do not, FCMs ask for more money, usually overnight, or advance funds to special customers to keep them in the game.

FCMs also contribute to guarantee funds at clearing houses — third parties that stand between buyers and sellers of futures — to “mutualise” loses in a major default. FCMs hold $456bn in customer funds, the CFTC says, with the two biggest being arms of JPMorgan Chase and Goldman Sachs.

FTX is seeking to bypass the brokers and use an approach that has evolved in the do-it-yourself, 24/7 crypto trade. In this world, digital assets move on computer networks that have no opening or closing times, or any of the traditional gatekeepers that were required by older technologies.

Under the FTX plan, customers would deposit collateral in FTX accounts — cash or crypto — and be responsible for keeping enough on hand to cover margin requirements at all times. Margin levels would be calculated every 30 seconds. If the margin falls too low, FTX would start liquidating the position in seconds, selling it off in 10 per cent increments or, in worst-case scenarios, offering it to “backstop liquidity providers who agree ahead of time to accept a set amount”. FTX also promised to put $250mn of cash into a guarantee fund.

FTX officials argue that the current practice of asking for margin creates a world of unsecured credit in which FCMs basically hope the customer will pay at some point. Their automated system would be safer, they say. Liquidations would be more frequent, but less ruinous. As proof, they pointed to the ability of their three-year-old international exchange to survive the ferocious volatility of digital asset prices.

“From a risk perspective, and this gets lost sometimes in discussions, I think our proposal is, in some senses, much more conservative . . . than the norm,” Bankman-Fried said in a Financial Times interview.

Don Wilson, chief executive of DRW, one of the world’s biggest derivatives traders, says his group has been “trading this way for some time in the crypto space” and has grown to like the 24/7 action. Because it can be moved around at all hours, crypto is very handy collateral for leveraged players looking to act quickly in the markets.

“One of the things that blockchain technology enables is more efficient and more real-time exchange of collateral. Once you have the ability to move collateral in a nearly instantaneous manner, then you can rethink the way you’re doing your margining,” he says.

“We have to manage the collateral in real time and we’ve never got closed out of a position [liquidated],” he explains. “People who don’t have the collateral get closed out of their positions and that’s a good thing. That reduces systemic risk and once you get it to the ability to very efficiently close out positions . . . now do you really even need an intermediary?”

Getting rid of gatekeepers

The case for human intermediation in futures markets took a real-time blow as industry executives met in Boca Raton. Across the Atlantic, the London Metal Exchange halted nickel trading for a week — and cancelled a day of trades — after a big bearish bet by Chinese metals tycoon Xiang Guangda backfired and left him facing huge margin calls. Activity only resumed after Xiang struck an agreement with banking counterparties including JPMorgan and Standard Chartered to keep his position open.

The debacle pointed to a hole in the defences erected by global regulators in response to the 2008 financial crisis and the role that opaque derivatives trading played in it. Officials pushed for more central clearing of trades and tougher margin requirements as a backstop for the system. But regulators were never able to construct a real-time risk management dashboard that would enable them to spot a big market player building up a dangerously large leveraged position.

As the LME reeled, FTX was making a well-timed sales pitch that it could fill the gap. Regulators would be able to log on to its website and see “to the penny” the “total amount of risk in the system”, FTX claimed. Some of that data could even be shared with the public, Bankman-Fried said.

“I think it would be cool to have a public dashboard that makes much more of this clear,” he says. “We know how much collateral exactly is in the system. We are custodying it. We have internal metrics and we have alarms that go off if that changes internally. We just haven’t made it public.”

The turbulence in commodities markets that followed the Russian invasion of Ukraine also gave FTX a chance to make the case for round-the-clock trading. As ruinous as that might be for the work-life balance of industry participants, it would allow investors and the financial system to adjust as quickly as possible to the outbreak of war or other disasters, the company argues.

“It’s not like waiting till Monday means you didn’t have risk over the weekend. It was there. You just were intentionally not paying attention to it,” says Bankman-Fried. “You can have more continuous deleveraging. You don’t have to have these three-day gaps in which war can break out.”

Not everyone, of course, is as enthusiastic. Craig Pirrong, a University of Houston finance professor, says he fears the mechanical FTX approach could prove “destabilising”, exacerbating market moves in either direction and possibly creating opportunities for bad actors to manipulate prices in hopes of triggering liquidations. He suggests the CFTC adds a “shock absorber” to the FTX system to slow down the action when necessary.

“This is a double-edged sword. There is a trade-off here,” he says. “Innovation should be allowed, but the potential issue with this innovation should be recognised and the CFTC should get ready to mitigate it.”

The CFTC has signalled it is going to take its time in deciding what to do. In a sign of the intense debate to come, the regulator has extended the original comment period on the FTX proposal by 30 days, to May 11. Market participants are already asking about the reliability of the FTX plan for back-up liquidity providers or whether it would concentrate risk in too few hands. Because futures are used by farmers and ranchers to hedge risks, agricultural interests could weigh in, complicating matters politically.

The FCM’s are another wildcard. FTX officials are taking pains to say that investors who want to retain their brokers can trade through them at their exchange. FTX does not mean to suggest that “just because we allow for disintermediation, there has to be disintermediation”, says Brett Harrison, president of FTX.US.

But the traditional players are unlikely to be happy. After long period of decline — in which the number of FCMs fell from 178 at the end of the 2005 to 61 in the latest CFTC survey — prospects for the business are looking up. Rising interest rates would make it more profitable to hold customer balances, says Carl Gilmore, president of Integritas Financial Consulting, who adds: “Don’t be surprised if you see a bunch of FCMs complaining about this in the next few weeks.”

The regulation fight

Whatever happens, the FTX proposal and the debate it has stirred marks a new phase in the drama over crypto regulation, which to this point has recalled Samuel Beckett’s Waiting for Godot, at least in the US.

In an executive order on crypto his year, Joe Biden signalled both his determination to regulate the industry — and the delays to come. The president’s declaration was short on details and long on studies. It will be months before detailed proposals emerge from his administration. Although a bipartisan group of legislators is discussing how to deal with crypto, final action on Capitol Hill will take time.

As a result, no single US regulator oversees the spot market in digital assets. While the CFTC takes an interest in crypto derivatives, there is a raging debate on Gensler’s assertion that many cryptocurrencies are securities under US law, making them fair game for the SEC. Most crypto exchanges in the US operate with money transmitter licenses.

“Would we like Congress to pass a bill that clarifies everything? Absolutely,” says Bankman-Fried, the son of two Stanford law school professors. “But that could take years.”

In the meantime, FTX is taking regulatory matters into its own hands. Bankman-Fried has already suggested to Congress that the CFTC should be made the regulator for all digital assets in US spot and derivatives markets. With its proposal to the CFTC, FTX is prodding its preferred regulator into action that could establish key rules of the road for traders.

“We would love to have more clarity around the right way to get licensed and registered for digital assets,” says Bankman-Fried. “I do think this is an attempt for us to find what seems like the best oversight that can be given, given the structure that exists today.”

Bankman-Fried started FTX only three years ago, first setting up an international exchange and then one for US users. The larger international operation is now worth more than Deutsche Bank or Credit Suisse, based on its $32bn valuation in January funding round that included Japan’s SoftBank and Canada’s Ontario Teachers’ Pension Plan.

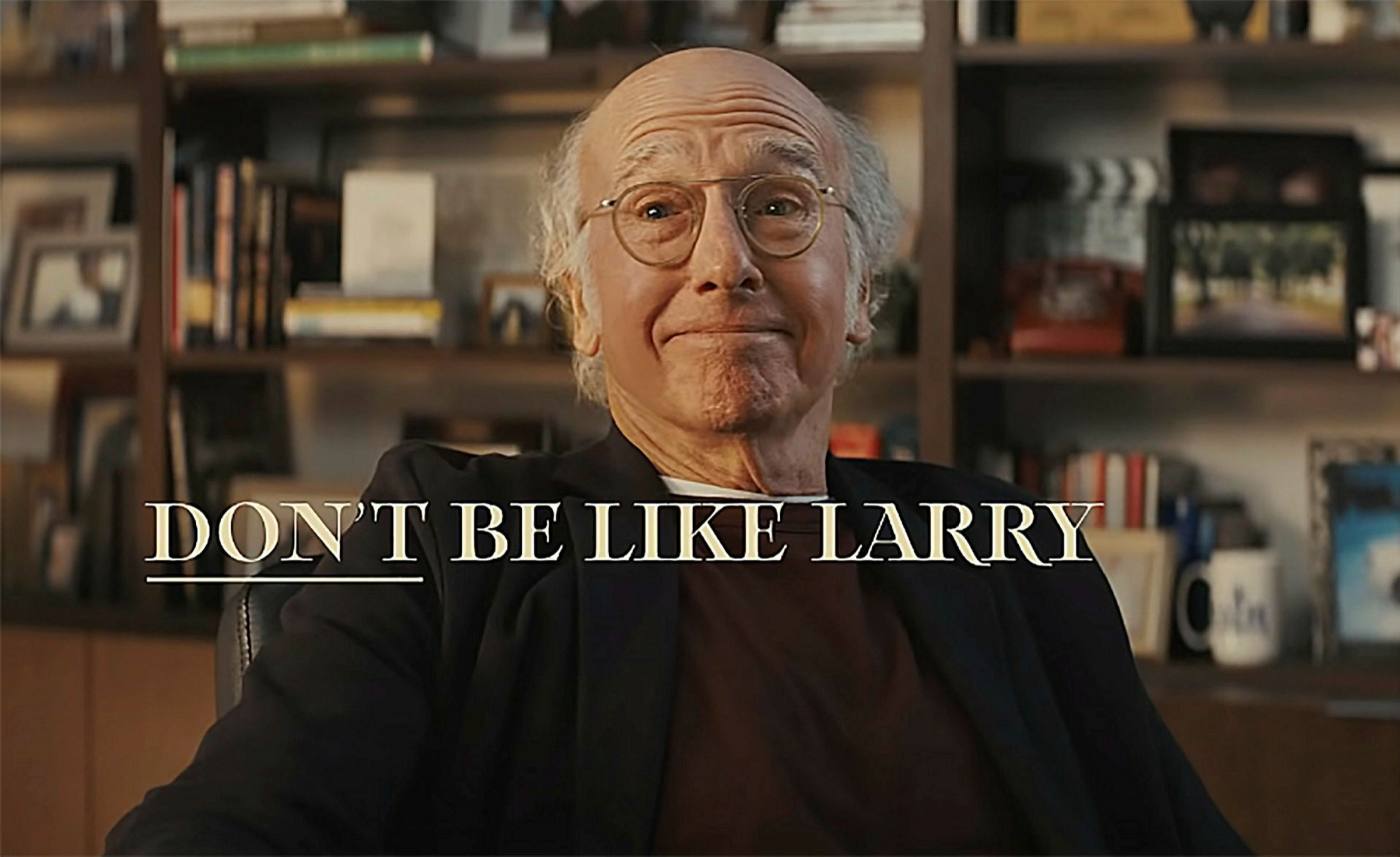

Down the road from Boca Raton, the Miami Heat of the National Basketball Association play in the FTX Arena. Larry David stars in the company’s commercials. The FTX chief executive has even mused about growing big enough to buy Goldman Sachs.

Bankman-Fried has made the scale of his ambitions clear to officials considering his proposal. In a letter sent to regulators in February by one of his in-house lawyers — one of several former CFTC employees working at FTX — the government was put on notice that he is only getting started.

“FTX plans to lead futures markets in the United States into the 21st century,” wrote Brian Mulherin, general counsel of FTX US Derivatives.