尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

It’s hard to talk about 21st-century economic history without discussing the “China shock”. That is the term often used to describe China’s entrance into the global market, a change that brought rich countries an abundance of cheap goods, but left entire industries and workforces mothballed.

在谈论21世纪的经济历史时,很难不提到“中国冲击”。这个术语通常用来描述中国进入全球市场的过程,这一变化为富裕国家带来了大量廉价商品,但也使整个行业和劳动力陷入停滞。

DeepSeek may provide a sequel. A little-known Chinese hedge fund has thrown a grenade into the world of artificial intelligence with a large language model that, in effect, matches the market leader, Sam Altman’s OpenAI, at a fraction of the cost. And while OpenAI treats its models’ workings as proprietary, DeepSeek’s R1 wears its technical innards on the outside, making it attractive for developers to use and build on.

深度求索(DeepSeek)可能会为这个故事带来续集。一家鲜为人知的中国对冲基金向人工智能领域投下了一颗重磅炸弹,他们推出的大型语言模型实际上以极低的成本匹敌市场领导者萨姆•奥尔特曼(Sam Altman)的OpenAI。尽管OpenAI将其模型的运作视为专有技术,深度求索的R1则公开其技术细节,使其对开发者来说更具吸引力,可以用于开发和构建。

Things move faster in the AI age; terrifyingly so. Five of the biggest technology stocks geared to AI — chipmaker Nvidia and so-called hyperscalers Alphabet, Amazon, Microsoft and Meta Platforms — collectively shed almost $750bn of market value before US markets opened on Monday. It could be particularly grim for Nvidia if it proves true that DeepSeek won without the use of its shiniest chips.

在人工智能时代,事情发展得更快,甚至令人感到恐惧。五大与人工智能相关的科技股——芯片制造商英伟达(Nvidia)和所谓的超大规模公司Alphabet、亚马逊(Amazon)、微软(Microsoft)和Meta——在周一美国市场开盘前,总市值共蒸发了近7500亿美元。如果事实证明深度求索在没有使用英伟达最先进芯片的情况下获胜,这对英伟达来说可能尤其严峻。

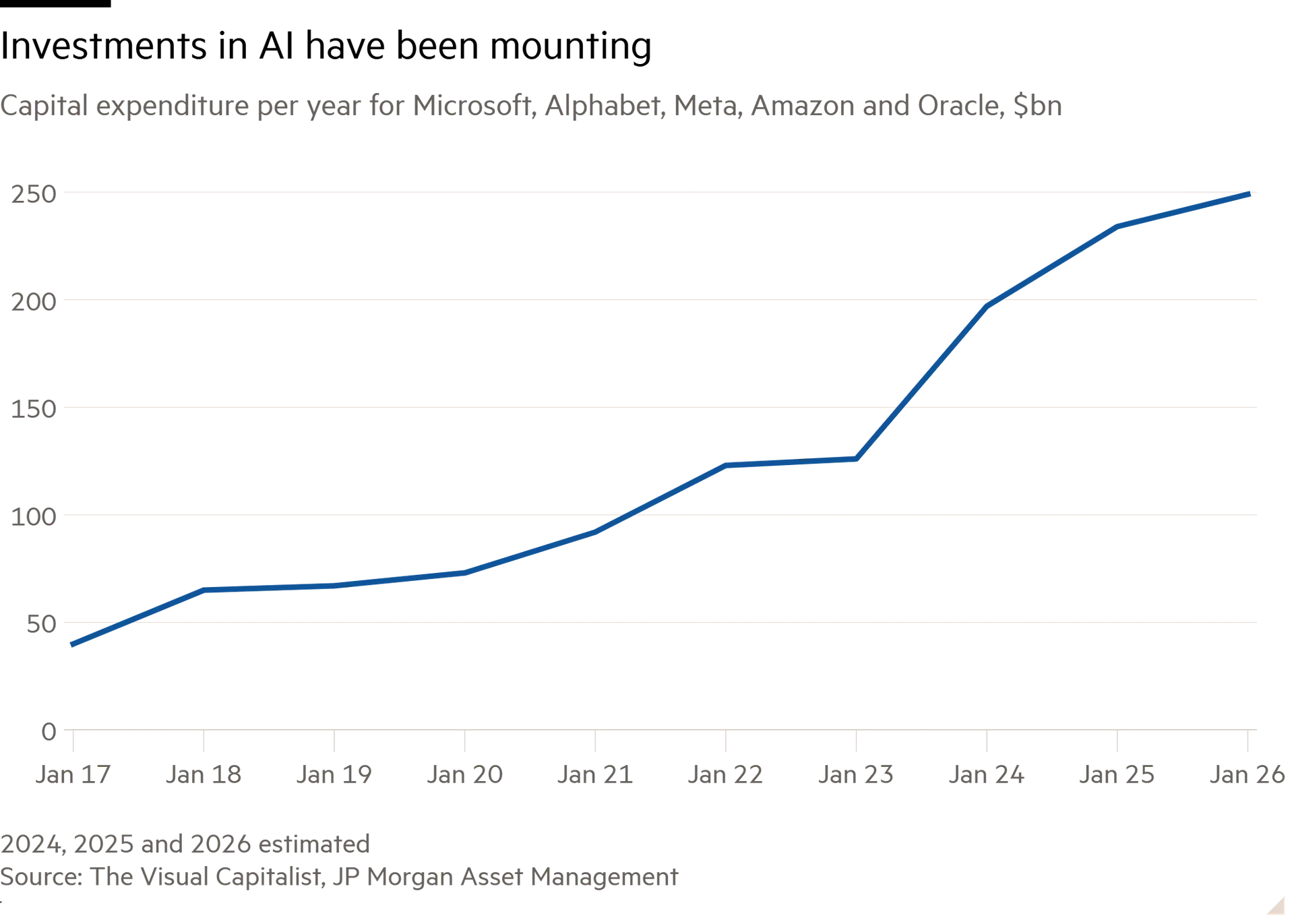

Investors in tech companies — including Europeans such as chipmaker ASML, and energy companies that investors hoped would get a boost from fuelling data centres — are left wondering whether their investments will go up in smoke. The hyperscalers were due to plough almost $300bn into capital expenditure this year, according to Visible Alpha estimates. Analysts expect that on Wednesday, when they report earnings, Meta and Microsoft will report investment for 2024 totalling $94bn.

投资于科技公司的投资者——包括欧洲的芯片制造商阿斯麦(ASML)和投资者希望通过为数据中心提供燃料而获得提振的能源公司——都在怀疑他们的投资是否会化为乌有。根据Visible Alpha的估计,超大规模企业今年的资本支出将达到近3000亿美元。分析师预计,Meta和微软将在周三公布收益时,报告2024年的投资总额为940亿美元。

In truth, the game isn’t over. DeepSeek’s actual potential is still unclear, and it has yet to achieve “artificial general intelligence”, the humanlike state that Meta and OpenAI are pursuing. But the rules might have changed. At the very least, DeepSeek may take some of the US giants’ customers. At worst, it has challenged the core belief that more hardware is the key to better AI. That principle has underpinned the market value of Silicon Valley companies as they invest hand over fist.

事实上,游戏还没有结束。深度求索的实际潜力仍不明朗,它尚未实现Meta和OpenAI所追求的“通用人工智能”,即类似人类的状态。但规则可能已经改变。至少,深度求索可能会吸引一些美国巨头的客户。最糟糕的是,它挑战了认为更多硬件是提升AI的关键这一核心信念。这个原则一直支撑着硅谷公司的市场价值,让他们不断地加大投资。

What’s bad for the hyperscalers could still be a windfall for everyone else. For most business users, having the absolute best model is less important than having one that’s reliable and good enough. Not every driver needs a Ferrari. Advances in reasoning such as R1 could be a big step for “agents” that deal with customers and perform tasks in the workplace. If those are available more cheaply, corporate profitability should rise.

对超大规模企业不利的事情可能对其他人来说仍然是意外之财。对于大多数商业用户来说,拥有绝对最好的模型不如拥有一个可靠且足够好的模型重要。并不是每个司机都需要一辆法拉利。像R1这样的推理进步可能是处理客户和在工作场所执行任务的“代理”们的一大进步。如果这些技术能够更便宜地获得,企业的盈利能力应该会提高。

In that sense, this second China shock could resemble the first. It could bring not just destruction but a reshuffling — albeit a painful one for many. Researchers have estimated that for every job lost to the China shock, US households’ purchasing power rose by more than $400,000. The race for AI supremacy is on pause; the great giveaway has begun.

从这个意义上说,第二次中国冲击可能会像第一次一样,不仅带来破坏,还会带来重组——尽管对许多人来说是痛苦的。研究人员估计,每失去一个因中国冲击而失去的工作,美国家庭的购买力就增加了超过40万美元。人工智能霸权的竞赛暂时停顿;大赠送已经开始。