尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

To President-elect Donald Trump, “tariff” is the most beautiful word in the dictionary. His campaign-trail proposals included a 60 per cent duty on Chinese goods and 20 per cent on European ones. All things being equal, higher duties should translate into less trade. Isn’t that bad for shipping? Maersk shareholders think not.

对当选总统唐纳德•特朗普(Donald Trump)来说,“关税”是字典里最美的词。他在竞选期间的提议包括对中国商品征收60%的关税,对欧洲商品征收20%的关税。在其他条件相同的情况下,更高的关税应该会导致贸易减少。这对航运业不利吗?马士基的股东们并不这么认为。

The 15 per cent rise in the Danish freight company’s stock over the past month suggests hope that — at least in the short term — Trump’s tariffs won’t entirely snarl up the shipping market. The US is a sizeable, rather than giant, tassel in the global trade tapestry. In tonnes, it accounts for 5 per cent of global seaborne imports, according to Clarksons, a shipping service provider. Bilateral US-China trade accounts for 1.4 per cent of global seaborne goods transport.

过去一个月,丹麦货运公司的股票上涨了15%,这表明至少在短期内,人们希望特朗普的关税不会完全扰乱航运市场。根据航运服务提供商克拉克森的数据,美国在全球贸易格局中是一个重要而非巨大的流苏。按吨计算,美国占全球海运进口的5%。美中双边贸易占全球海运货物运输的1.4%。

Tariffs could even raise US imports, at first. A surge looks inevitable, as importers seek to stockpile goods ahead of the duties kicking in. Even thereafter, consumers may swallow higher prices to a degree, and companies settle for lower margins.

关税起初甚至可能增加美国的进口量。由于进口商试图在关税生效前囤积商品,进口激增似乎不可避免。即便在此之后,消费者可能会在一定程度上接受更高的价格,而公司则可能接受较低的利润率。

Where stuff just gets too expensive, other imports could take up the slack. A harder bludgeon for Chinese-made products would leave European companies at a relative advantage in the US market. And even where locally-produced goods shake out ahead, it would take US companies some time to increase their production capacities.

当商品价格过高时,其他进口商品可能会填补空缺。对中国制造产品采取更严厉的打击将使欧洲公司在美国市场上处于相对优势。即使本地生产的商品领先,美国公司也需要一些时间来提高生产能力。

The impact of a near-term surge in shipping demand would be amplified by the stretched state of the shipping market. Disruption in the Red Sea has lengthened journeys, and while freight rates are off their peak, the Shanghai Containerized Freight Rate is still more than twice as high as it was in 2023.

近期航运需求激增的影响将因航运市场的紧张状态而被放大。红海(Red Sea)的中断延长了航程,尽管运费已经回落,但上海集装箱运价(Shanghai Containerized Freight Rate)仍比2023年高出两倍多。

By way of history, Trump’s last experiment with tariffs ended up clipping global seaborne trade — measured in tonnes/km — by only 0.5 per cent. Trouble is, such calculations only stack up if global growth holds up, and trade mostly moves around to adjust to tariffs. But trade wars have a habit of escalating as recipients slap on tariffs of their own. Over time, that would sink global GDP, and shipping demand with it.

从历史上看,特朗普上次的关税实验最终只使全球海运贸易(以吨/公里计算)减少了0.5%。问题在于,这种计算只有在全球经济增长保持稳定的情况下才成立,而贸易大多会为了适应关税而调整。但贸易战往往会升级,因为受影响国家也会加征关税。随着时间的推移,这将导致全球国内生产总值下降,航运需求也会随之下降。

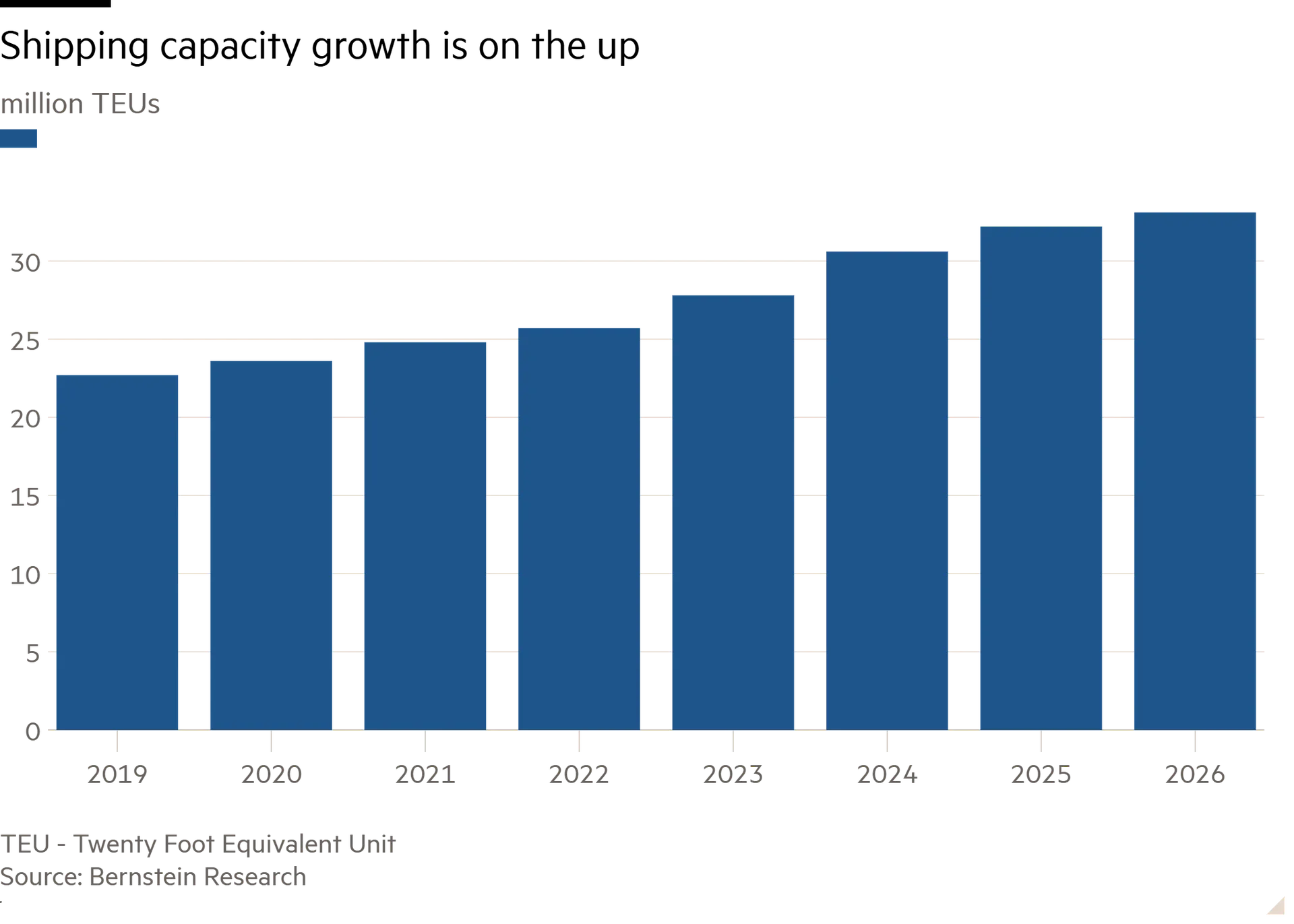

That’s particularly worrying given the sector spent its Covid-era bonanza on new ships. Next year’s fleet is set to be more than 40 per cent larger than that in 2019, according to Bernstein. The combination of looming risks to global growth and shipping overcapacity would certainly make for choppy waters.

这一点尤其令人担忧,因为航运业把新冠疫情时代的红利都花在了新船上。伯恩斯坦认为,明年的船队规模将比2019年扩大40% 以上。全球经济增长面临的隐患和航运业运力过剩的双重压力,无疑会让这片水域波涛汹涌。

The path from campaign pronouncement to actual policy is unclear, so it is hard to estimate with accuracy the size and shape of disruption to global trade. Investors are for now betting that it is nothing shipping companies like Maersk cannot navigate around.

从竞选宣言到实际政策的路径尚不明确,因此很难准确估计全球贸易中断的规模和形式。投资者目前押注,像马士基这样的航运公司能够应对这些挑战。