European battery start-ups are jostling to meet demand as electric vehicle take-up accelerates. France’s Verkor is the latest to raise money. It secured more than €2bn this week for its first plant, in northern France.

In theory, new plants promised by domestic and international companies could quickly amount to overcapacity.

Ten battery cell plants in production in Europe have a combined capacity of 166.5 gigawatt hours, says Benchmark Mineral Intelligence. A further 26 are planned by the end of the decade. If all materialise, total capacity would increase to 1,227 GWh.

However, actual production will be much lower, at an estimated 729 GWh. Production can take several years to ramp up. Demand in 2030 is forecast at 1,004 GWh. It is possible too that some start-ups will drop out. The US Inflation Reduction Act’s subsidies may lure other projects stateside.

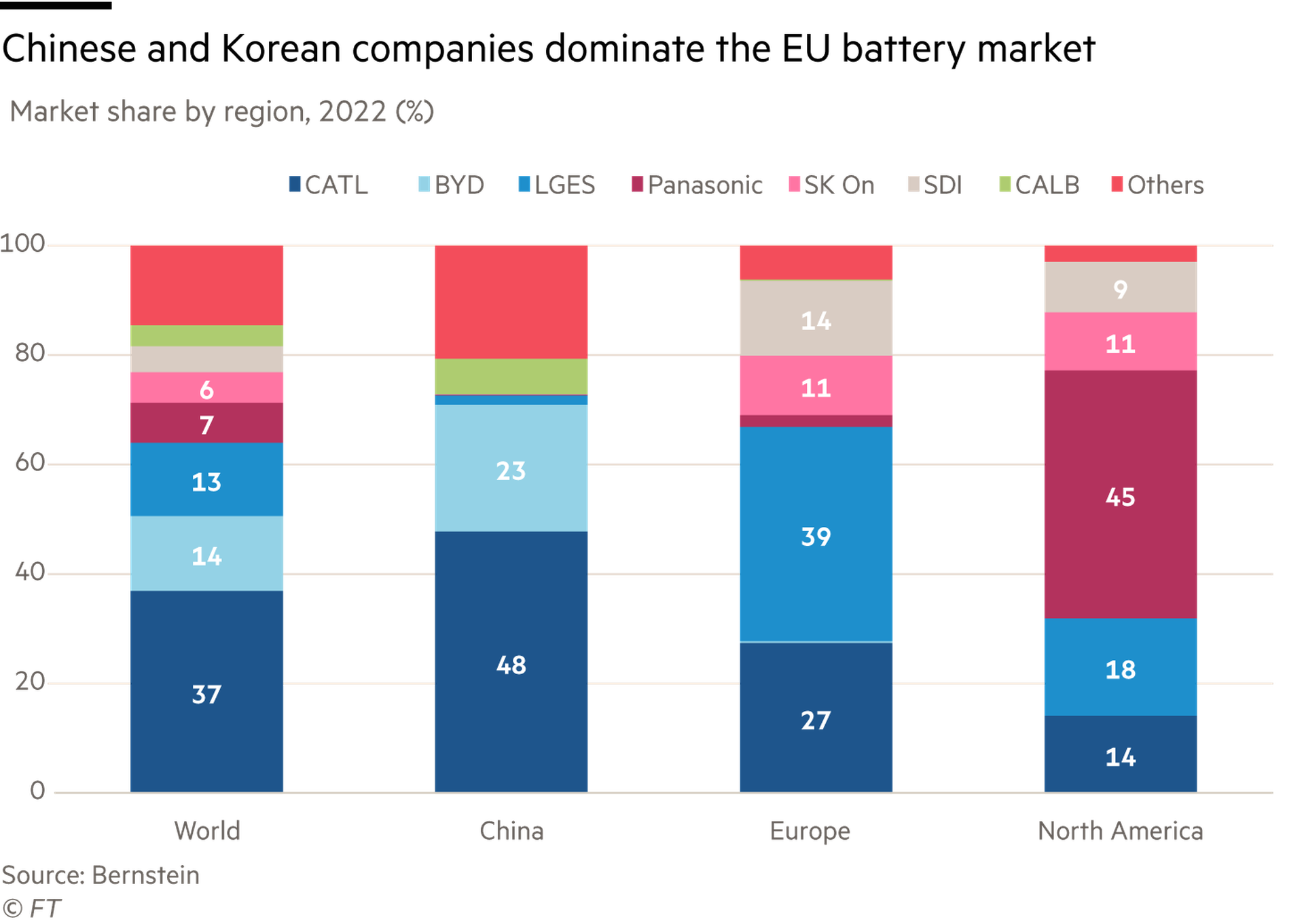

This means there is no reason for European players to decelerate. The market is dominated by Asian players such as South Korea’s LG Energy Solution and Chinese group CATL. They too have plants in Europe, including in Poland and Germany.

About half of battery cells used in Europe last year were produced domestically. Imports from China and South Korea covered the balance, says campaign group Transport & Environment.

Raising import tariffs on battery cells would help domestic suppliers. But it risks further tensions with China. Beijing has already hit out at the EU’s anti-subsidy probe into China’s car industry.

A less fraught option would be for EU carmakers to use their clout to secure vital raw materials for use by their suppliers. Some are already doing this. Europe’s battery makers have a good shot at keeping pace with Asian rivals.